Curious about something in Ashland? Just Ask, by completing this simple ONLINE FORM.

Curious about something in Ashland? Just Ask, by completing this simple ONLINE FORM. You may also reach out to the City of Ashland Communications Officer, Dorinda Cottle, dorinda.cottle@ashland.or.us.

Below, view questions from others in your community.

Frequently Asked Questions

The Army Corp did not do an evaluation report. In 2017/2018, a company named, Black and Veatch, did an evaluation / cost comparison for rehabilitation vs building new. See Scott Fleury’s, Public Works Director, Council Study Session staff report (PDF) that was presented to Council on May 6, 2024.

Released May 14, 2024

Released May 14, 2024

Timber Products Company in Yreka was the only mill (out of six mills solicited) to submit a price for the logs being sold by the City.

Released April 29, 2024

Released April 29, 2024

This building along with all City facilities are being reviewed as part of our facilities optimization plan. Once that is complete, next steps will be discussed on needed actions on facilities to include City Hall.

Released April 28, 2024

Released April 28, 2024

Currently there is no discussion of a command center. The City has an agreement with SOU (Southern Oregon University) for the use of their EOC (Emergency Operations Center) infrastructure as needed.

The intent of the purchase of the building at 2200 Ashland Street was for the site to serve as a severe weather shelter as stated in the application for the grant. The Homeless Mater Plan and future Ad hoc Committee for the site will determine additional uses of the location.

Released April 5, 2024

The intent of the purchase of the building at 2200 Ashland Street was for the site to serve as a severe weather shelter as stated in the application for the grant. The Homeless Mater Plan and future Ad hoc Committee for the site will determine additional uses of the location.

Released April 5, 2024

We're currently running a pilot program featuring 11 innovative cans strategically positioned throughout the downtown area. These locations were selected based on feedback regarding trash overflow, ensuring they target high-traffic areas effectively.

Most of these new cans boast solar compacting technology, enabling them to maximize capacity and minimize overflow between scheduled pick-ups by Recology Ashland. Each can comes at a cost of $4783*, inclusive of a 5-year warranty and custom art wrap, with a total project budget of $145K. The pilot program itself amounts to $60K, funded through the Tourism Fund's Transient Lodging Taxes.

As we assess the success of this initiative, we'll evaluate its impact before considering further deployment. Additionally, as part of our downtown beautification efforts, we'll be introducing hanging flower baskets during spring and summer, alongside piloting new landscaping in downtown beds. (Special thanks to local photographers Bob Palermini and Jesse Smith for their stunning images featured on the cans.)

*The cost of our previous trash receptacles were $1975/each.

Released March 26, 2024

The project is currently out to bid and will close in April 2024. The City expects to award the construction phase in May and begin construction in early summer. If construction goes smoothly, both facilities will be open in late fall 2024 to early winter 2025.

Released March 18, 2024

Released March 18, 2024

State incentive plans require that the City order replacement parts through a qualified vendor. Unfortunately, shipments can be delayed due to supply and demand. Station No. 5 is in the process of being replaced with a new unit, as the parts ordered for it did not fix the issue with the station.

The City’s goal is to install up to 22 new EV Chargers in 2024, with the possibility of expansion, and the new stations will be of higher quality. Future locations include Winburn Way along Lithia Park, the Hargadine Garage and the City lot on 2nd St (above E Main St).

The City currently has public charging stations for electric vehicles at the following locations:

Released March 12, 2024

The City’s goal is to install up to 22 new EV Chargers in 2024, with the possibility of expansion, and the new stations will be of higher quality. Future locations include Winburn Way along Lithia Park, the Hargadine Garage and the City lot on 2nd St (above E Main St).

The City currently has public charging stations for electric vehicles at the following locations:

- Ten chargers at the parking lot at Lithia Way and N Pioneer St - 130 N Pioneer St

- Two chargers at the Hargadine St parking garage - 175 Hargadine St

- Four chargers at the parking lot at The Grove - 1195 E Main St

Released March 12, 2024

When the severe weather shelter is activated, the City posts a notification on the City website. The news post will be visible in the newsfeed on the City home page for the duration of the shelter being open – ashland.or.us. In addition, the City sends out a Citizen Alert notification to a SHELTER subscriber list via text. Join this list by texting 97520SHELTER to 888777. The City does not have a phone line dedicated to the severe weather shelter.

Released February 13, 2024

Released February 13, 2024

For fiscal year ending 2024, we are budgeting $3.7M.

Released February 2, 2024

Released February 2, 2024

As part of the City’s TAP (Talent-Ashland-Phoenix) connection to the Medford Water Commission (MWC) there are a few significant hurdles.

- City currently has 1000 acre-feet of storage in Lost Creek Reservoir. In order to expand for full demand of the community, more water rights would need to be purchased and approved. This involves the Army Corps of Engineers and Water Resources. The City would expect significant hurdles from a regulatory standpoint because the City already has a full supply within Reeder Reservoir as developed in the Water Management and Conservation Plan with some assistance from the existing TAP system. To get to the annualized demand using the TAP system the City would need around 3500 acre-feet of stored water right in Lost Creek Reservoir.

- Medford has previously stated the maximum they will provide the City of Ashland through the TAP system is 3 million gallons a day (MGD), which is 4 MGD less than the design criteria and future demand projections of the City.

- If Medford were to agree to an increase to account for the full demand of the City, there would be significant infrastructure improvements required to get to a peak capacity of 7 MGD, which is what the new plant is designed for. These improvements would be in Medford, Phoenix, Talent, Ashland and some within ODOT (Oregon Department of Transportation) right of way. Nothing is designed and constructed currently to handle Talent, Phoenix and the maximum day demand of Ashland at 7 MGD. Significant modeling analysis would need to be done to define the system improvements both from a pipeline standpoint, but also a pump station standpoint. Depending on the outcome of the analysis, minor or major changes to the TAP master plan would be required to define infrastructure maintenance responsibilities along with cost capacities. A minor example of infrastructure issues is the current Ashland TAP station and connecting pipelines were designed for the maximum 3 MGD flow. There is also not booster pump station in the City’s system that moves TAP water from the Granite Zone to the Crowson Zone feeding residents south/east of the Ashland Creek divide. There is a project to install a station; however, this will not happen for a few more years.

- The City would need to negotiate with the MWC on system development charges (SDC) for the increased demand and it is expected that the cost for this alone to be in the millions of dollars. The City negotiated a $2.6 million dollar SDC with the MWC for the current 2.13 MGD delivery of TAP water.

- The current rate for TAP water is 0.97 cents/1000 gallons in the summer and 0.77 cents/1000 gallons in the winter. This recently increased by 0.044 cents in a recent rate adjustment. It is expected that regular annual increases by MWC will take place as the Commission moves forward with major expansions and system improvements. For example, right now the annual people and maintenance budgets for the water fund (~$8 million and divide that by total gallons produced annually ~1 billion) you get 0.01 cents/gallon. This is expected to also be low considering the new plant, because chemicals and power requirements will be less than the current plant.

- If the City were to move forward with a project to determine the feasibility of a full connection, and MWC was agreeable, it is expected that the process would last anywhere from five to 10 years. This includes modeling and feasibility analysis, infrastructure planning, public outreach/education, multijurisdictional coordination, environmental permitting, preliminary design, final design, construction and development of the funding process for all improvements required to create a full connection. All the while, the City is still paying to maintain the existing plant.

City staff recently met with the Oregon Health Authority to discuss the currently unregulated Lithia Water System. The State currently believes this system meets the definition of a public water system and thus is requiring regulation of the system. There are different components to how a public water system is defined and regulated by the Oregon Health Authority. Staff will continue to work with the Oregon Health Authority and will discuss this change in decision by the State with the City Council to finalize a path forward. Until that path forward is defined and the system meets the drinking water requirements, the fountains will remain shut-off to the public.

Released November 13, 2023

Released November 13, 2023

Currently, there is only one available program with the City of Ashland that may help with the cost of improving defensible space on private property. It is called the Ashland Wildfire Mitigation Project (a FEMA Pre-Disaster Mitigation grant), and it provides up to a maximum reimbursement of $2,150 for vegetation mitigation work to improve the defensible space around your home. Only specific types of trees qualify to be removed as part of this grant project (based on species, condition, and distance to a structure that would be assessed by a Risk Reduction Specialist) and other requirements would also need to be met on the property, in order to receive funding. In addition, only a pre-qualified number of homes are able to participate in the grant project to receive reimbursements. This grant was awarded in mid-2021 to target risks around the top 1,000 at-risk homes within Ashland city limits (wildfire risk).

Please check out our webpage Ashland Wildfire Mitigation Project for more details on the grant. On that page, there is a link to provide your contact information if you would like further info as to whether your property qualifies for the grant. Thank you for working to reduce wildfire risks around your home.

Released October 12, 2023

Please check out our webpage Ashland Wildfire Mitigation Project for more details on the grant. On that page, there is a link to provide your contact information if you would like further info as to whether your property qualifies for the grant. Thank you for working to reduce wildfire risks around your home.

Released October 12, 2023

Yes, during the summer months, the City will offer an irrigation evaluation and customize a watering schedule at no charge. Learn more in the "Love Your Water," August 2023 newsletter.

Yes, both Uber and Lyft are authorized to operate in Ashland. Drivers must be registered with the Ashland Police Department by visiting ashland.or.us/TaxiInfo and completing an application – This is for Taxi and Limo Driver applications too.

Released July 24, 2023

Released July 24, 2023

It is illegal in Ashland to feed deer, raccoon, wild turkeys, bear and cougars. Please do not scatter food or garbage or any other attractant that might lure a wild animal. Want to learn more? Check out the Ashland Municpal Code at ashland.municipal.codes, or reach out to our new Code Compliance Specialist, Lisa Evans, codecompliance@ashland.or.us, 541.552.2424. You may also submit issues via our online form.

Released April 11, 2023

Released again on May 5, 2023

Released April 11, 2023

Released again on May 5, 2023

Bear carts are once again available at Recology Ashland and generally cost an additional $6/month. More information at recology.com/recology-ashland.

Released April 5, 2023

Released April 5, 2023

The Transient Occupancy Tax (TOT) also referred to as the hotel/motel tax, generates approximately $3 million and is used for three purposes: Economic and Cultural Development, tourism promotion and the remainder for general expenses in the General Fund such as police and fire. The hotel/motel rate in Ashland is currently ten percent (10%). The hotel/motel keeps five percent (5%) of the money collected as payment for processing.

Released April 4, 2023

Released April 4, 2023

The following items should NOT be flushed down the toilet: cleansing wipes (even if they are marketed as flushable), gloves, masks, feminine products, dental floss, cat litter, paper towels and so on – These items will not breakdown, rather they will trap hair and absorb grease. Flushing these items can clog your toilet, and potentially cause serious problems in the City sewer system (in the street and at City facilities – or worse, the backups can impact homes, rivers or streams). The only thing that should be flushed down the toilet is bathroom waste (human) and toilet paper and nothing else.

Released April 4, 2023

Released April 4, 2023

We strive to deliver services essential to the community and enhance quality of life. Ashland revenue is primarily collected from the fees paid for services. Another major source is Property Tax, which generates approximately $24 million for the City. It is used to pay for expenses found in the General Fund such as police and fire, for some of the City’s principal and interest on debt and for expenses in providing parks and recreation. Property owners within the Ashland city limits pay $4.2865 per $1,000 of assessed value for the City’s share of the total property tax assessed.

Released March 26, 2023

Released March 26, 2023

Snowplowing is done according to pre-established priority routes. For example, routes to the Ashland Hospital and major arterials will take precedence over collector streets and neighborhoods. (The more traveled roads are the highest priority, followed by less traveled neighborhood street.) View the Snowplow Route Map.

From the City home page, ashland.or.us, click to Subscribe for daily City updates. Subscribers can tailor the information they would like to receive from City; for example, City News, Agendas & Minutes, Calendar and more.

Each evening at approximately 6:15 p.m. subscribers receive an email from the City of Ashland. The email will include items posted for the day that they subscribed to see.

In addition, follow the City on Twitter and Facebook:

@cityofashlandoregon Facebook

@cityofashland Twitter

Each evening at approximately 6:15 p.m. subscribers receive an email from the City of Ashland. The email will include items posted for the day that they subscribed to see.

In addition, follow the City on Twitter and Facebook:

@cityofashlandoregon Facebook

@cityofashland Twitter

Budget:

The City of Ashland has a biennium budget. The City of Ashland’s municipal budget is the projected financial operating plan for a two-year period. The City’s fiscal year runs from July 1 to June 30. The budget accounts for expected revenues and allocates resources to particular expenditures. Revenues are projected into the future based on historical revenues and current or projected impacts, such as a pandemic, that are estimated to potentially affect those projections. The same is done for expenditures. Expenditure allocations are based on historical needs but also current and projected impacts, such as high inflation, that may impact needed funds. Oregon State Budget law requires the budget to be balanced. This means that the City’s revenues must be equal or greater than total expenses. The budget is often referred to as a living thing or document as supplemental budgets occur regularly as events unfold during the biennium to align with unforeseen circumstances or changes that were not known when the original budget estimations and planning occurred. The supplemental budgets realign allocated funds to appropriate departments or programs as needed to ensure needed expenditures can occur.

Audit:

The City of Ashland produces an annual comprehensive financial report, which includes a municipal audit done by an independent audit firm comprised of certified public accountants. Oregon State Law requires local government file annual financial reports and due to the size of our City, the City of Ashland is required to be audited annually. The annual comprehensive financial report is a report of actual revenues collected and expenditures and, unlike the budget, which are estimates and projections, the audit reviews how much revenue was actually collected and how funds were actually spent as well as the condition of the City’s assets. The audit is not of the City budget. The audit is conducted by reviewing actual revenue and expenditure financial statements that provide an overview of how all financial activity. The audit also reviews internal controls to ensure the proper fiduciary care is taken to deter errors or fraud from occurring. The audit also provides a comprehensive look at the City’s assets and liabilities to provide insight to the City’s current financial position in the Management Discussion and Analysis section of the annual comprehensive financial report.

Budget = estimate of needed $

Audit = review of how $ was actually spent

To review current and past budgets and annual financial reports which contain the annual audits by an independent firm please visit: Financial Documents - Finance - City of Ashland, Oregon.

The City of Ashland has a biennium budget. The City of Ashland’s municipal budget is the projected financial operating plan for a two-year period. The City’s fiscal year runs from July 1 to June 30. The budget accounts for expected revenues and allocates resources to particular expenditures. Revenues are projected into the future based on historical revenues and current or projected impacts, such as a pandemic, that are estimated to potentially affect those projections. The same is done for expenditures. Expenditure allocations are based on historical needs but also current and projected impacts, such as high inflation, that may impact needed funds. Oregon State Budget law requires the budget to be balanced. This means that the City’s revenues must be equal or greater than total expenses. The budget is often referred to as a living thing or document as supplemental budgets occur regularly as events unfold during the biennium to align with unforeseen circumstances or changes that were not known when the original budget estimations and planning occurred. The supplemental budgets realign allocated funds to appropriate departments or programs as needed to ensure needed expenditures can occur.

Audit:

The City of Ashland produces an annual comprehensive financial report, which includes a municipal audit done by an independent audit firm comprised of certified public accountants. Oregon State Law requires local government file annual financial reports and due to the size of our City, the City of Ashland is required to be audited annually. The annual comprehensive financial report is a report of actual revenues collected and expenditures and, unlike the budget, which are estimates and projections, the audit reviews how much revenue was actually collected and how funds were actually spent as well as the condition of the City’s assets. The audit is not of the City budget. The audit is conducted by reviewing actual revenue and expenditure financial statements that provide an overview of how all financial activity. The audit also reviews internal controls to ensure the proper fiduciary care is taken to deter errors or fraud from occurring. The audit also provides a comprehensive look at the City’s assets and liabilities to provide insight to the City’s current financial position in the Management Discussion and Analysis section of the annual comprehensive financial report.

Budget = estimate of needed $

Audit = review of how $ was actually spent

To review current and past budgets and annual financial reports which contain the annual audits by an independent firm please visit: Financial Documents - Finance - City of Ashland, Oregon.

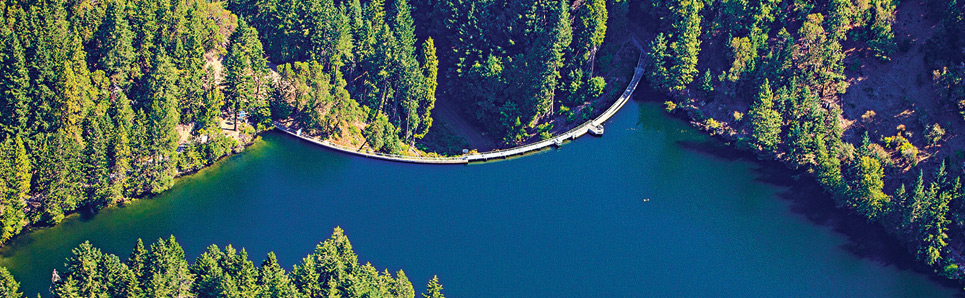

Ashland’s primary water source is Reeder Reservoir, located in the mountains above Lithia Park. Reeder Reservoir receives its water from the Ashland watershed which begin at the peaks of Mt Ashland and Wagner Butte and flow into the East and West Forks of Ashland creek before entering the reservoir.

Ashland’s primary water source is Reeder Reservoir, located in the mountains above Lithia Park. Reeder Reservoir receives its water from the Ashland watershed which begin at the peaks of Mt Ashland and Wagner Butte and flow into the East and West Forks of Ashland creek before entering the reservoir. In addition to Ashland’s primary water source, the City has two secondary supplies. These include supply from the Talent Irrigation District (TID) delivered through their canal system to the City that can be treated at the water treatment plant, and delivery of treated water from the Medford Water Commission through the Talent-Ashland-Phoenix (TAP) intertie.

Learn more

A: The current Look Ahead can be found under Council Business, ashland.or.us/CouncilBusiness, or by viewing the City Council page and clicking on Council Business. From here you may view the following:

- Agendas and Minutes

- Ordinances

- Resolutions

- Proclamations

- Streaming Video of Council meetings

- Council Look Ahead

Subscribe for daily email alerts at ashland.or.us by clicking on SUBSCRIBE (below News & Info). You can customize your subscription to receive only a little information or stay abreast to all that is happening in the City of Ashland. Notification options include:

- Agendas and Minutes

- City News

- Projects

- Calendar

- Employment

- RFPs (or requests for proposals)

View current job opportunities with the City of Ashland

View City of Ashland Financial Documents/Reports

View City of Ashland Budget Information/Reports on OpenGov.com

View City of Ashland Budget Information/Reports on OpenGov.com

Submit a public records request by completing an online form. The time needed to process the request varies from 30 minutes, up to two or more weeks for in-depth requests. For more information, please visit the City Recorder page.

Online City Services

UTILITIES-Connect/Disconnect,

Pay your bill & more

Pay your bill & more

Connect to

Ashland Fiber Network

Ashland Fiber Network

Request Conservation

Evaluation

Evaluation

Proposals, Bids

& Notifications

& Notifications

Request Building

Inspection

Inspection

Building Permit

Applications

Applications

Apply for Other

Permits & Licenses

Permits & Licenses

Register for

Recreation Programs

Recreation Programs